There’s a common wisdom in the community that being a founder is a race against time.

In other words, can you reach your next milestone before you run out of money?

How you choose to fund your pet startup can wildly affect your cash flow, growth, and competitive edge in the market.

Today, we’ll dive into bootstrapping vs investment — which path should you choose to get your pet startup off the ground? And where does corporate partnership come into it?

Let’s discuss!

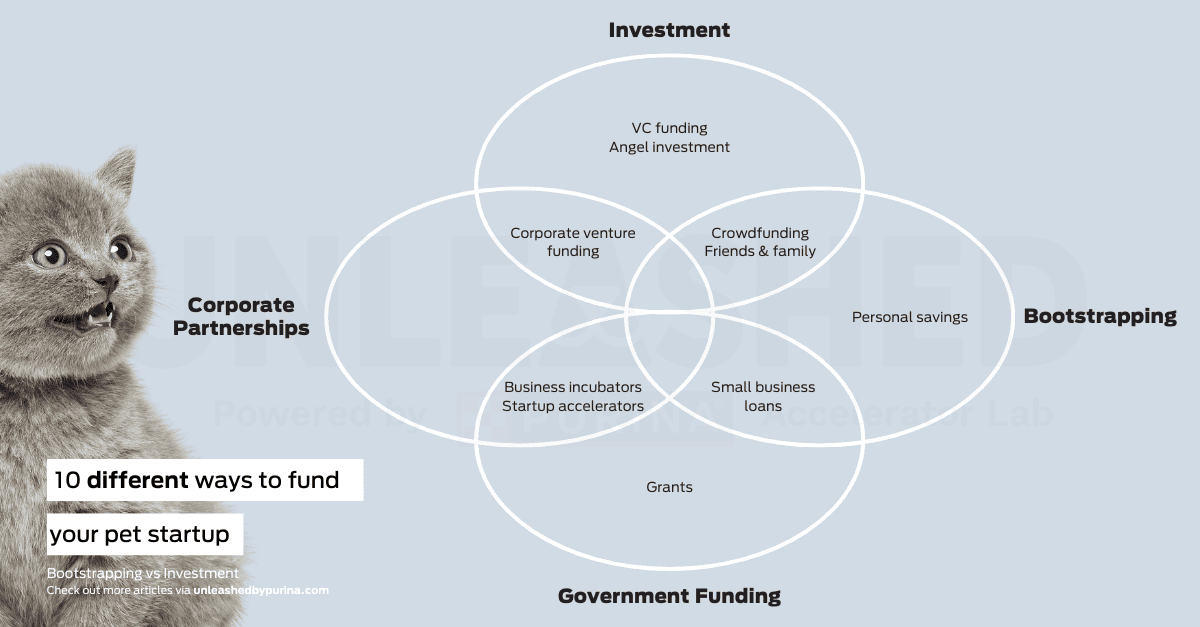

10 different ways to fund your pet startup

82% of businesses fail because of poor cash flow management, and the way you raise funds can affect your choices.

For simplicity, today we’re talking about bootstrapping vs investment. But there are multiple ways to bootstrap and multiple ways to get funded. Here are ten methods to think about:

Bootstrapping

- Personal savings

- Crowdfunding

- Family and friends

Traditional Funding

- VC funding

- Angel investors

Corporate Partnership

- Business incubator

- Startup accelerators

- Corporate venture financing

Government Funding

- Small business loans

- Grants

Now, these ten funding paths don’t fall neatly into the categories described here. Governments run business incubators. Family and friend rounds can be equity-based or equity-free. So, the overlap looks more like this:

Before we look at which approach could work best for you, remember that your funding path is only one piece of the broader puzzle. No matter how you choose to fund your pet startup, you still need good business acumen to manage those funds efficiently. Plus, it’s fair to say that managing bootstrapped funds vs invested funds requires different parts of your entrepreneurial brain.

Let’s start by deep-diving into bootstrapping.

Bootstrapping

In the simplest of terms, bootstrapping involves investing your own funds and building cash flow (quickly) to get your business off the ground. Working with limited resources requires grit and resourcefulness, but it’s an excellent way to validate that your startup has a place in the pet market.

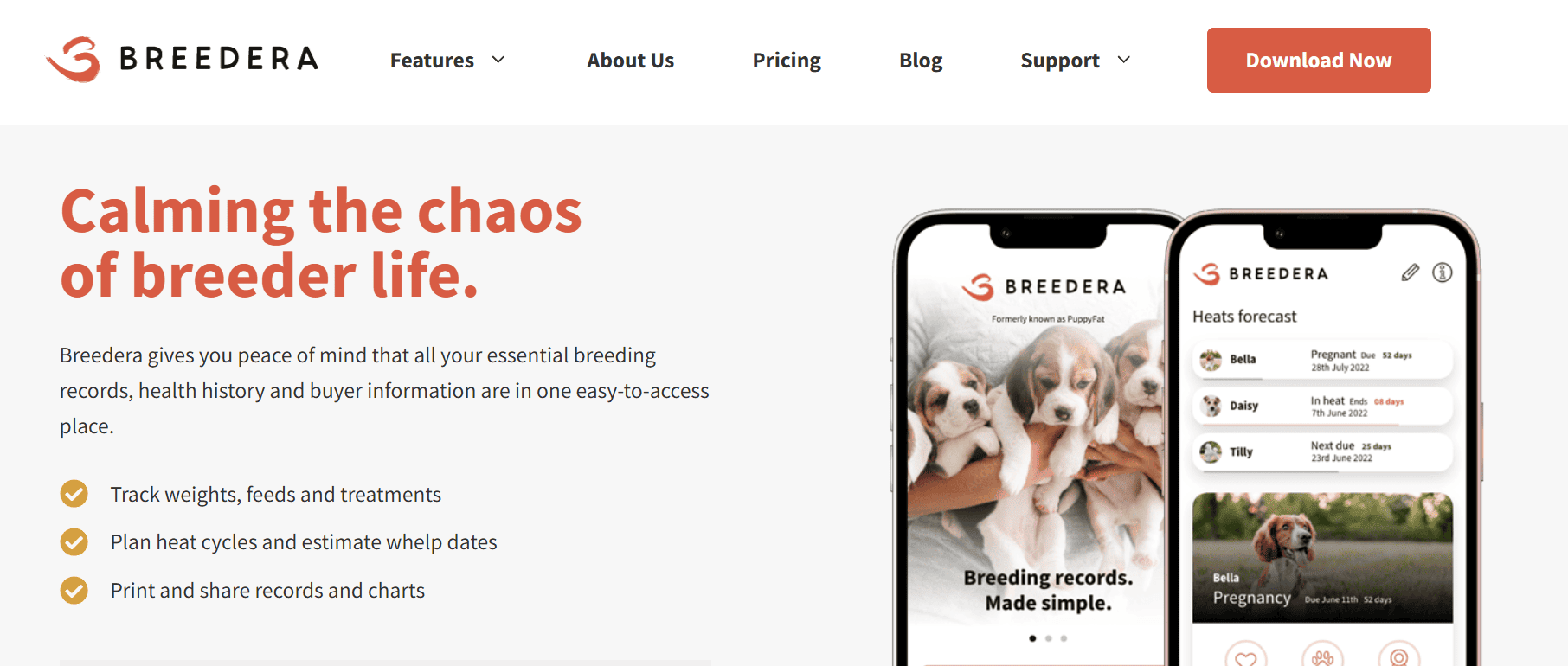

Breeding record-keeping app, Breedera, is a pet tech startup that is proudly bootstrapped. The idea sprung while founder and CEO, Michael White, was working in his family’s business that manufactures companion animal breeding equipment and veterinary incubators.

“It was at that time that I noticed a severe lack of digitalisation in the animal breeding space,” he said. “Breeders tend to use pen and paper to keep records. So there was a clear niche for the software.”

Bootstrapping Breedera was more of a happy accident than an intentional funding strategy. It started as a side hustle, with a limited MVP, funded by Michael himself. When the software gained popularity and word spread among the breeder community, he knew he had a winning idea.

Michael said, “As the app generated revenue, I simply reinvested it back into further development, following the requests of our early user base. Throughout the journey, there have been several times I’ve considered investment, but the truth is we haven’t needed it! We’re lucky to have a dedicated customer base, so we have a healthy runway right now.”

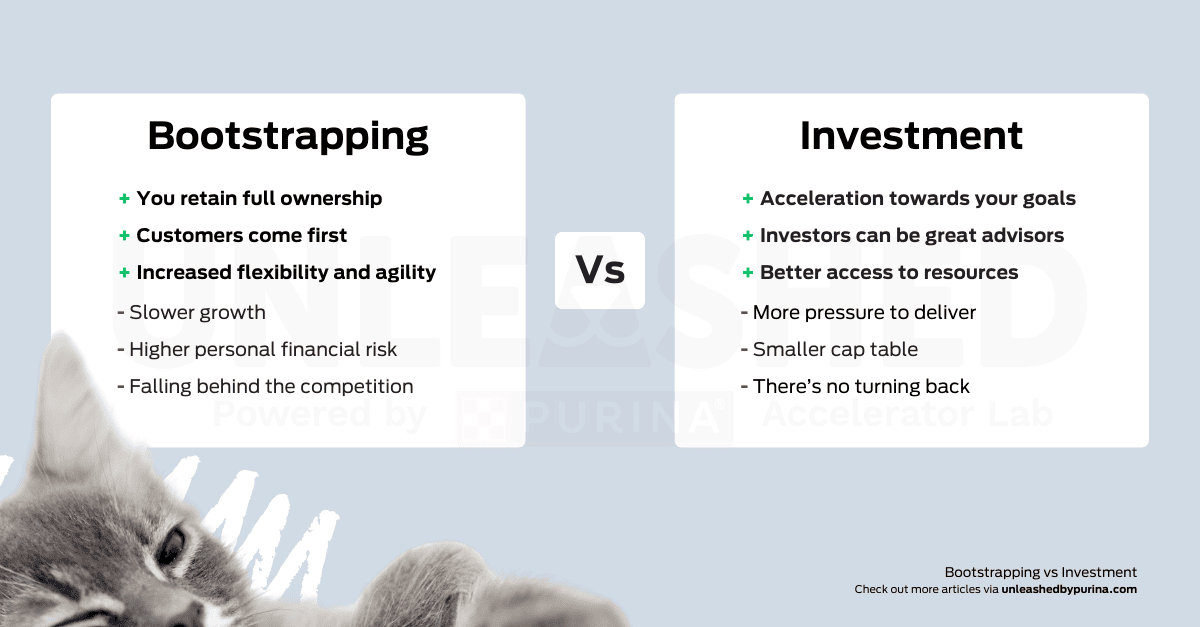

Here are the pros and cons of bootstrapping to consider:

Pros of bootstrapping

- You retain full ownership: When you have full ownership of your startup, you can make your own decisions without external input. You’ll also make a larger return if and when you sell your business.

- Customers come first: Customers are important for every pet startup. However, bootstrapped companies have a particularly close relationship with their early adopters because they rely on them for cash flow. Having a direct feedback loop with your audience helps you understand their needs far better.

- Increased flexibility and agility: Bootstrapped startups are much more agile to market fluctuations. If your business hits a rocky patch, you can respond quickly by scaling back resources. This is why studies show VC-backed startups are hit hardest during economic downturns.

Cons of bootstrapping

- Slower growth: A limited budget means you need to be cautious when taking financial risks like new hires. This can slow down your growth dramatically.

- Higher personal financial risk: Investing your own money or taking out small loans incurs a lot of personal responsibility for your business’ success. Therefore, you’ll inherently be more cautious with the business risks you take.

- Falling behind the competition: If your product has a fast market adoption curve — for example with AI-based technology — you could fall behind your competition without significant financial resources.

Tips for bootstrapping your pet startup

The key to effective bootstrapping is to see cash flow as investment. That means getting your product in the hands of users as soon as possible and charging a reasonable rate to keep growth going.

Breedera founder and CEO, Michael White, described it as unofficial crowdfunding. To take this approach, you need to be nimble to the demands of your customers and militant about your numbers.

Michael told me, “I have an obsessive overview of our numbers. I check our revenues daily, the bank balance several times per week, and every couple of weeks, I complete our cash-flow spreadsheet which estimates future revenues and costs, and accordingly adjusts our runway. We’re not at break-even yet, but we’ve managed to successively extend our runway through perseverance and continual adjustment. Every penny counts, so we make every penny count.”

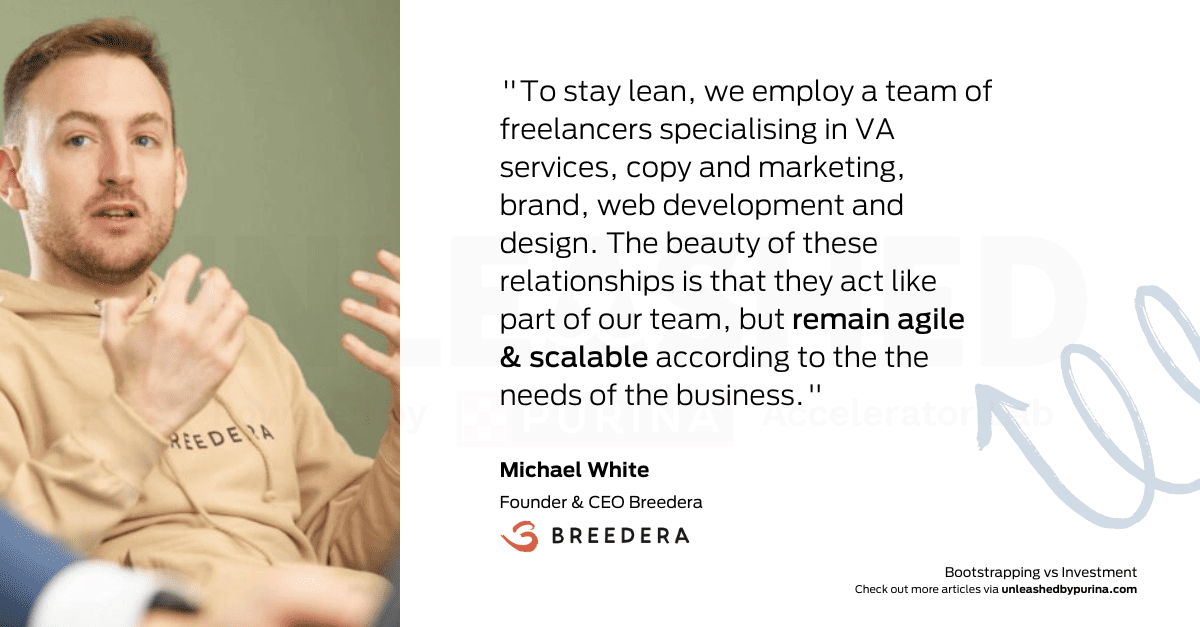

While managing a leaner budget, staying lean is paramount. That means keeping your team small and maximising efficiency as much as possible.

“To stay lean, we employ a team of freelancers specialising in VA services, copy and marketing, brand, web development and design,” said Michael. “The beauty of these relationships is that they act like part of our team, but remain agile and scalable according to the needs of the business.”

To summarise, the bootstrapping founder is a resourceful one. If you have a product that doesn’t have an urgent, fast-moving market, a frugal bootstrapped approach could be a great choice.

After all, gaining traction and runway on your own is the ideal proof of concept for investors if you want to seek funding down the line.

Now, let’s talk about investment.

Investment

Taking on an investment seems like a right of passage for pet entrepreneurs in many ways. What better way to show faith in your product than to convince an industry expert to invest in your vision?

Finding an angel investor or VC funding can be a gruelling process, but that extra investment can catapult your pet tech idea into full bloom.

As an example, Australia-based RightPaw is a marketplace that connects aspiring pet parents with responsible breeders. Co-founder and CEO, Nathan Olivieri, first came up with the idea with his wife and licensed vet, Dr. Imogen Tomlin-Game.

“My wife, Imogen, realised that the single biggest difference that she could make in a pet's life was actually much closer to the very start. If you're helping the owners find well-bred, healthy dogs from the right places, you're ultimately setting the pup up for the best possible success across its entire life. That’s how the idea for RightPaw started.” Nathan told me.

Once the seed was planted, Nathan joined a startup accelerator programme where he met his co-founder, Adelaine Ho. Though pitching for funding was a key milestone of the accelerator, Nathan also mentioned that timing was one of the deciding factors for seeking investment. Launching in 2020, amidst the COVID-19 pandemic, meant there was a sudden surge in demand for puppies in Australia. Funding could help the team capture that market and better serve their audience.

RightPaw raised a six-figure pre-seed round and has since had further investment from Nestlé Ventures.

Are you considering seeking external capital?

Here are some pros and cons:

Pros of funding

- Acceleration towards your goals: Gaining investment can give you the strategic boost to reach your next milestone. This is particularly important if you’re in a highly competitive sector or there’s an accelerated need for your product.

- Investors can be great advisors: If you choose investors wisely, you can gain unparalleled industry knowledge and connections. Investors are often successful entrepreneurs themselves who may be able to advise you through tough times.

- Better access to resources: Having access to top-quality talent and tech cannot be understated as you grow your pet startup. More funds means affording the best of the best in the areas that matter.

Cons of funding

- More pressure to deliver: Taking on funding means promising a result for your investors. Whether your investors are super involved or not, you’ll have a driving pressure to reach the milestones you promised them. How you manage that pressure largely depends on your personality and the investors you choose.

- Smaller cap table: The more funding rounds you do, the smaller your cap table becomes. This means that your return will be much smaller if/when you exit.

- There’s no turning back: If you choose to take on VC funding or angel investment, you’re making a definitive decision to continue down the funding path. Ultimately, investors — particularly VC funds — want you to achieve an exit that makes them a return on their investment. Therefore, unless you restart your business from scratch, you can’t scale back from VC investment to bootstrapping. This funding path only points in one direction.

Tips for getting funded

Believe it or not, getting funded is a little simpler to navigate than bootstrapping. That doesn’t mean it’s easy — competition is fierce — but the steps are much clearer. Bootstrapping is a more nebulous journey.

First, get clear on why you need the money.

RightPaw co-founder and CEO, Nathan Olivieri, said, “I encourage founders to ask themselves: Why do you need the money? Ultimately, you're taking that funding on board to either accelerate the business or for a particular purpose. Knowing the answer to that will make sure you're making the right decision.”

Once you’re clear on your goals, do your research to find the right investors for your pet startup.

Nathan mentioned how incredible it has been to work alongside investors who are passionate about the pet industry. Having your board made up of pet tech insiders, experts and aficionados makes your startup journey much smoother.

After identifying the right people to approach, you need to build a stellar pitch deck that includes:

- Your brand story

- Financial projections

- Current traction and progress

- Introductions to the founding team

Investors want a charismatic, knowledgeable founding team, a clear vision and solid financials. Nail those and you’re in with a good chance of securing funding.

So, where does corporate partnership fit in? Let’s talk about it.

Corporate partnership

Corporate partnership works for both bootstrapped and traditionally funded startups.

It’s a mutually beneficial arrangement between the corporation and the startup to help them get to the next level.

How? Let’s look at the case studies we’ve discussed so far. RightPaw and Breedera have partnered with Nestlé Purina, but in very different ways. During our conversations with them, both founders cited this partnership as a key part of their growth journey so far, offering them industry insight and a boost in resources in multiple ways.

The Unleashed by Purina startup accelerator programme was the way in for Breedera.

“Discovering Unleashed by Purina was pure luck,” said Michael White, Founder and CEO of Breedera. “Through my connections at a local business incubator, I was made aware of the programme. The programme offered CHF 50,000 in project funding with no equity and a short contractual agreement. It was perfect for what I needed to take Breedera beyond just a hobby.”

After the Unleashed by Purina accelerator programme, Breedera was then selected to be part of the 3-year business incubator programme. Through this, Michael mentioned the incredible access to industry knowledge and networking opportunities.

He said, “Through the Unleashed by Purina programme, Jeanne and Kim have been focused on creating a startup community. One that supports each other and learns from each other. This has resulted in lots of networking opportunities.”

RightPaw’s founders were introduced to Nestlé Purina by one of their angel investors, which led to Nestlé Ventures investing in the startup in 2022.

Nathan Olivieri, co-founder and CEO of RightPaw, said, “I think the investment from Nestlé Ventures was a big part of accelerating our growth. Plus, we still had autonomy around strategy and operations which was really important to us as well.”

Partnering with Nestlé Purina also meant adding value to their product in unique ways.

Nathan said, “We were able to offer some real value to our breeders and buyers by bringing on board a Purina PRO PLAN partnership. That way, we could ensure that pups can start off on the right paw.”

What you need to know about corporate partnerships

If you’re thinking about applying to the Unleashed by Purina accelerator programme or pitching to a corporate VC arm like Nestlé Ventures, here’s what you need to know:

- Corporations don’t want to steal your idea: This seems to be a common hesitation but here’s the truth. Partnering with startups that can remain agile and at the forefront of innovation ensures growth and prosperity for all parties involved. Corporations like Nestlé Purina far prefer to champion and boost innovation in the pet space through partnerships than to impact their core business models.

- You maintain independence: In most cases, corporate partnerships are partnerships in the purest sense of the word. You maintain your team and full control of your trajectory. The corporation provides resources to help you achieve your goals.

- Expect to learn a lot: More than monetary or technological resources, knowledge is the main benefit you’ll get from a corporate partnership. Whether that be market research reports or industry connections, you often gain access to industry insight that you wouldn’t get anywhere else.

- Equity-free financing exists: Not all programmes ask for equity. For example, Unleashed by Purina has an equity-free startup accelerator programme focused on getting your company to the next level.

- Brand endorsement helps you go further: Having a brand name affiliated with your company is not only attractive to the press and potential customers, but also to future investors.

If you want to partner with Nestlé Purina, applying to join our Unleashed by Purina startup accelerator is a great place to start. Subscribe to our newsletter to find out when applications open.

Final thoughts: Navigating your funding path as a pet startup

Nathan said it best: “Not every business needs external capital. What are your ambitions for the business? Are you looking to grow at your own pace but a potentially slower burn? Or do you want to grow at a faster pace but take on the stress of meeting targets and delivering on the promises that you made to investors?”

But here’s a final point to chew on.

It’s rare for a pet startup to live out its entire life on just one type of investment. Many startups start bootstrapped and take on funding down the line. Or start with a government loan and then take on an angel investor. And as you saw, the corporate partnership works with any of these paths.

Your funding journey may take many turns, but, ultimately, you need to choose the strategy that aligns with your product and growth goals.

As you race against the runway, only you will know how to bring your vision to life.