Expanding your pet startup into foreign markets is an exciting prospect. Not only can you further your brand’s reach and influence, but you can also wildly increase your revenue.

Fortunately, we at Purina know a thing or two about expanding your pet business’ horizons.

In this blog, we’ll talk about:

- The pros and cons of entering a foreign pet market

- Whether your pet startup is ready to go international

- How to enter a foreign market step-by-step (including proven strategies)

- If your startup should enter the international market

Consider this the complete guide to world domination for pet startups. Let’s dive in!

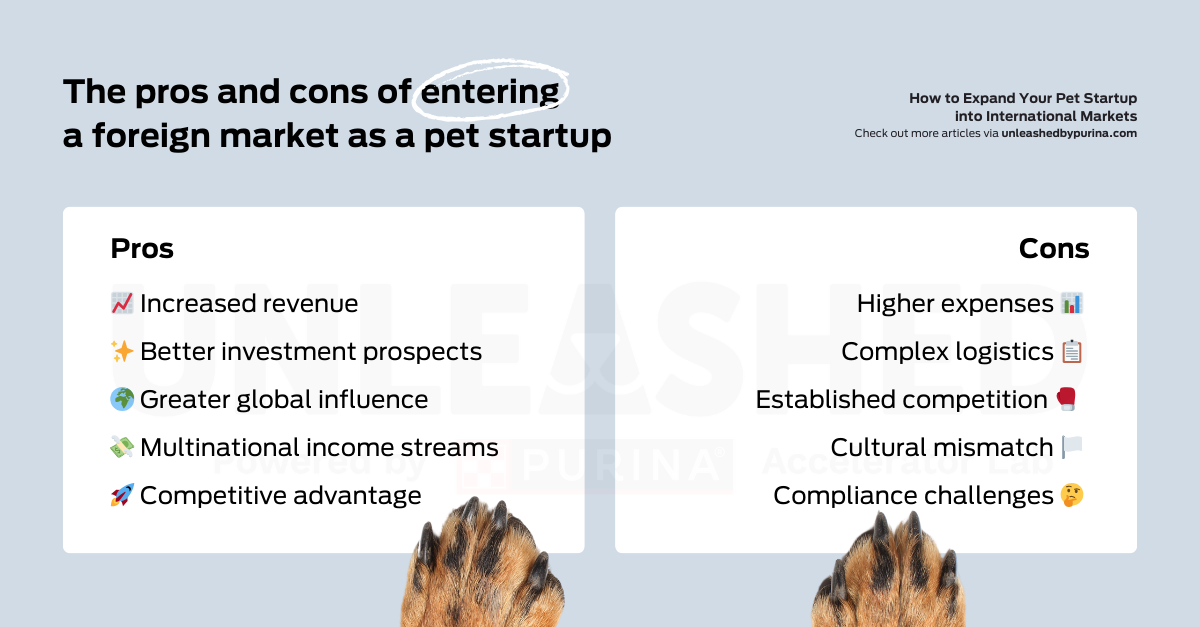

What are the pros and cons of entering a foreign market?

If you’re not entirely sure if entering a foreign market is the right move for your pet startup, fear not. The pros and cons below will help you make the right decision.

The pros of taking your pet startup global

Here are just some of the benefits of entering international markets:

- Increased revenue: More markets equals more sales opportunities.

- Better investment prospects: Investors love international brands. You’ll also have a better chance of having your pet startup acquired.

- Greater global influence: You’ll grow your brand awareness overseas and therefore have a bigger influence in the industry.

- Multinational income streams: Selling in multiple markets mitigates your risk of a downturn.

- Competitive advantage: A global brand can fare better against competitors.

The cons of entering a foreign pet market

Sadly, expanding your pet brand’s reach isn’t all upside. Here are some drawbacks worth thinking about:

- Higher expenses: Entering new markets can require significant financial resources.

- Complex logistics: Shipping, translation and time zones can put a strain on your processes.

- Established competition: Pet parents tend to be loyal to local brands they’re already familiar with.

- Cultural mismatch: If you choose the wrong market, you could struggle to sell due to cultural differences.

- Compliance challenges: Local laws can be complicated to navigate.

These cons can all be mitigated with in-depth market research.

Before we get into that, how do you know if your pet startup is ready to expand?

Let’s discuss.

Is your pet startup ready to enter a foreign market?

Sure, global domination is an ambition for most startup founders. However, not all businesses are suited to becoming the next Amazon—at least not in their current iteration.

So how do you know if your pet startup is ready to enter an international market?

Here’s a useful checklist to find out:

- Is your startup making predictable revenue in its current market?

- Do you understand the local pet industry and where your product fits?

- Do you have adequate funding for hiring, marketing and set-up costs?

- Are your delivery processes well-defined?

- Do you understand the regulations in the countries you’re considering?

- Is your business equipped to handle overseas logistics and customer service?

- Does your product compare favourably to international competitors?

- Can your team adapt to servicing a foreign market?

- Do you have a network in the market you’re interested in?

This seems like a long list but having your ducks in a row lowers your risk.

That said, not all of these factors are of equal weight. It depends on the international market entry strategy you choose.

For example, US-based pet tech startup PetLibro managed to expand into overseas markets relatively quickly by partnering with local distributors in strategic countries such as France and Germany. Because of the ease of exportation across borders in the EU, a pet parent in Poland can purchase a PetLibro device despite the company having no base there.

The most important thing is that you have the monetary and human resources to take your business abroad.

How to enter an international market: step by step

Ready to take over the world with your pet startup? Here’s our step-by-step guide.

Choose the right market

Figuring out your product-market-fit overseas is the million (perhaps billion) dollar question.

Here are some key factors to consider when choosing the right market:

- Demand: Do local pet parents want your product or service? You can build a customer avatar to target your ideal audience.

- Competition: Is there established competition for your brand in the country or region? This could be both good and bad. Competitors validate that there’s a demand for your product, but it can be difficult to compete with local companies.

- Local culture: Do the cultural attitudes, around pets, align with your company values? The market will respond better to your product if they understand exactly how it’ll fit into their pet parenting routine.

- Taxes: What are the local taxes you may face? Some countries are friendlier towards international imports than others.

- Transportation/delivery: How will you deliver your product to the local market? This is a factor for pet tech apps too.

- Regulations: Are there any local laws or regulations that could hinder your business? Also, look at future regulation proposals (e.g. the EU AI framework).

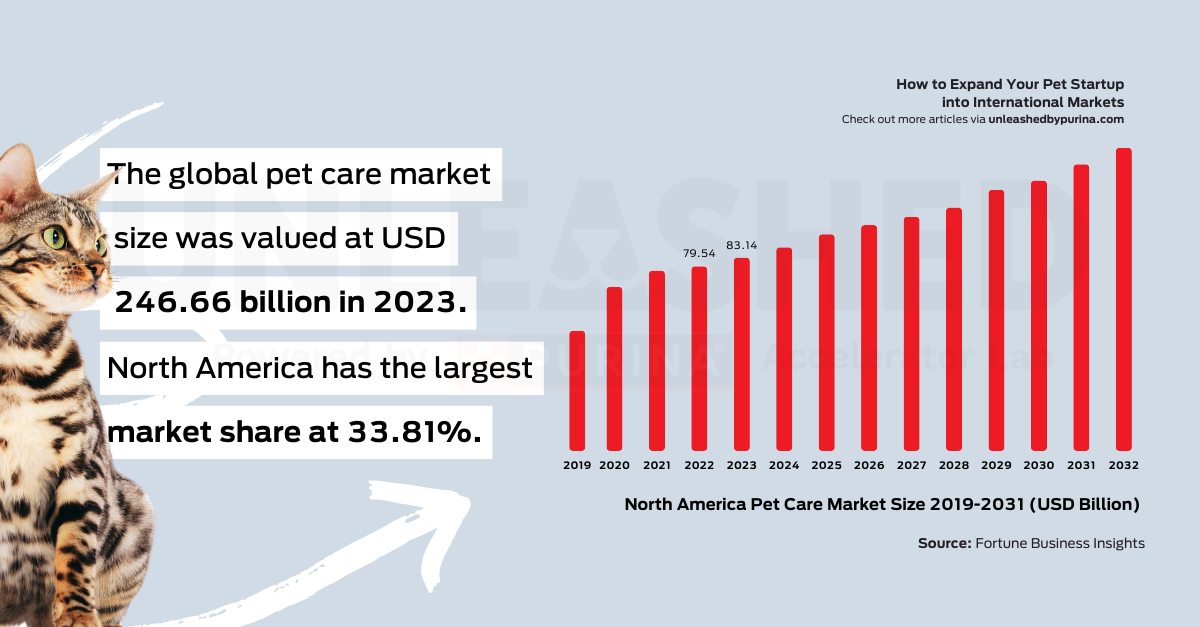

With all that said, you’re probably thinking that the US is the best foreign market to tap into (if you’re not based there already).

In some ways, you’re right!

The US market is the Moby Dick of the pet world. Who wouldn’t want a slice of that $80 billion whale?

However, that’s the problem. The US pet industry is so large and highly segmented that it’s a behemoth task for any small startup to conquer. You can’t take down Moby Dick with a pen knife.

This is not to steer you away from the US. On the contrary; it’s by far the largest and most profitable market in the global pet industry.

Just be mindful of the scale and start small. We’ll have more tips on cracking the US market as we go along.

For now, there’s more research to do. So… read on!

Understand the local industry

Cultural intelligence is a huge factor when it comes to taking your pet brand international.

See, it’s common to live in a bit of a bubble in the pet industry. Surely all pet owners have the same concerns no matter where they are; the health and happiness of their furbabies.

However, every culture has a different idea of how to achieve that. Even within a continent or country, the differences are vast. So it’s vital you pair your product with the cultural sensibilities of the region.

Take Rover, for example. This US-based dog-sitting startup only expanded into the European market in 2018, after servicing 1 million pet owners in the US and Canada. They chose the UK as the first country because of its renowned pet-friendly culture. Christopher Cederskog, European General Manager at Rover said, “In the UK alone, 90 percent of pet owners consider their pet a part of the family. Rover connects pet parents with service providers who will treat their dogs like family.”

Rover’s strategy paid off! The app is now established in eight European countries and was acquired by Blackstone in February 2024 for $2.3 billion.

To get your cultural intelligence on point, you need to get as many data points as possible. We also recommend conducting your own research with targeted experiments aimed at real pet parents.

Top tip: A common mistake is to overhire once your business expands into other territories. While it’s tempting to open a new office and double your staff, it might not be necessary. It depends on your market entry strategy. You should definitely hire or promote someone to oversee the market expansion to avoid stretching your current team too much. However, hiring a new local team, when you haven’t validated the market, is a huge risk.

Consider the timing

If you’re selling a disruptive piece of pet tech, your timing for expansion is a big factor.

You have two options:

1. Be the “first to market” and introduce an entirely new product.

2. Wait for a competitor to test the market for you and follow their lead.

As the first to market, you can set the standard and break new ground. You can be the brand to disrupt the local industry and get pet parents excited about your product.

However, being first means you may have more regulatory and commercial hoops to jump through. You may also face resistance from local consumers who are unfamiliar with your product. After all, not all pet parents are the same.

On the other hand, you could wait for a competitor to break the market. You’ll have a much lower barrier to entry as there will be a validated consumer base. Plus, your competitor will likely iron out most of the regulatory kinks before your arrival.

The con? You’ll have established competition! Local pet parents are more likely to have an affinity to the first-to-market brand, so your marketing team will need to work hard to differentiate your product.

A great example of a company that played the waiting game is Tractive. Even though the Austrian-born pet GPS tracking startup was founded before other popular pet wearable and tracking brands like FitBark and Furbo, they didn’t decide to break into the US market until 2021.

Tractive even hired the former general manager of Furbo to help spearhead their entry into the US market. By cementing their user base in Europe first, they could ride the pet wearable boom in the US and become one of the top-performing companies in the sector.

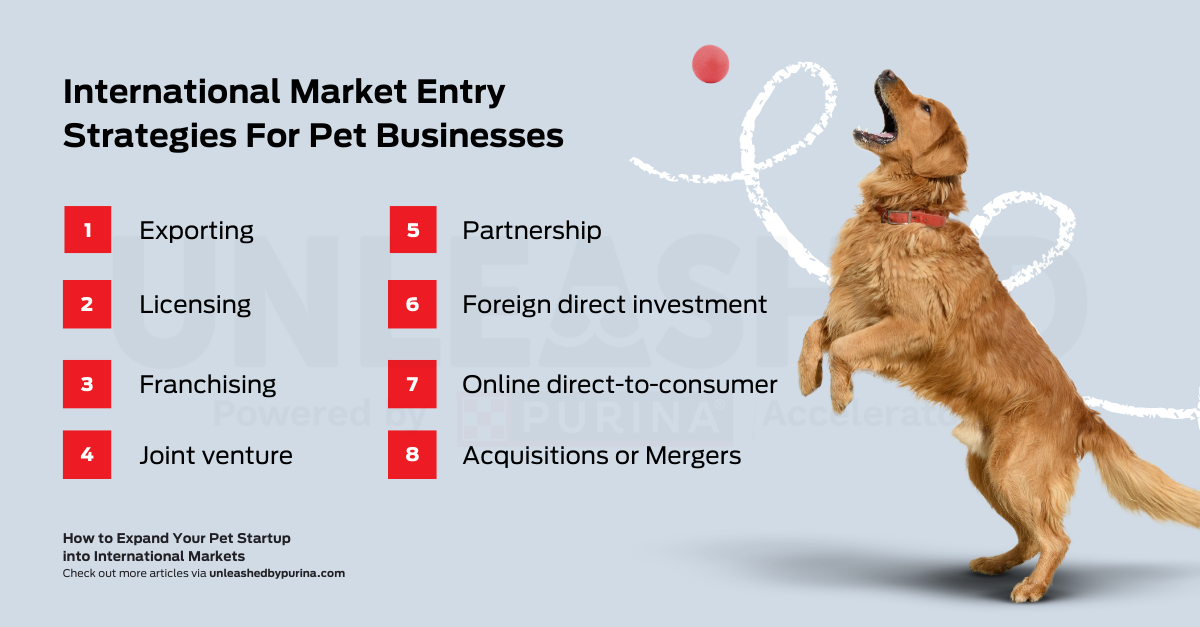

Decide on your entry strategy

Here is a quick overview of the best international market entry strategies for pet businesses:

- Exporting: Create your products in your home country and partner with local distributors/agents to sell in the new market.

- Licensing: Permit overseas businesses to use your trademark, production process or patents.

- Franchising: Allow foreign companies to use your intellectual property to create and deliver your product/service on your behalf.

- Joint venture: Launch a new joint-owned company with a local firm.

- Partnership: Partner with a local business or competitor to market, sell and/or distribute your product.

- Foreign direct investment: Acquire assets in an overseas company to gain a tangible strategic base in the foreign market.

- Online direct-to-consumer: Sell and ship your products directly to consumers via e-commerce platforms.

- Acquisitions or mergers: Acquire or merge with established companies abroad.

There are pros and cons to each, so do thorough research to choose the right avenue for you. You should also create detailed projections on how much your go-to-market strategy may cost.

Test the market

In the previous sections, we talked about the theory behind entering foreign markets. But in truth, you won’t know if your product will sink or swim until you try—no matter how much soul-searching you do. Though you’re well-passed the MVP stage of your startup, it’s time to adopt that mindset again.

So, how do you test out a new market?

Start with one product in one country and conduct a streamlined marketing campaign.

If you’re targeting the US, go even slower. One city, one product, one partner or distributor, etc.

Dipping your toe in the water prevents you from going all in on a market that might not react the way you’d hoped.

English pet food company, Lily’s Kitchen, expanded into one European country at a time via local distribution deals. By 2016, five years after the company’s inception, the brand was only in six other countries. From 2019 onwards, they expanded into Asia, tapping into huge pet markets in Japan, South Korea and China. Lily’s Kitchen is now established in 30 countries worldwide and was acquired by Nestlé Purina PetCare in 2020.

Final thoughts: Should your pet startup enter the international market?

To end this blog, here’s a challenging question:

Should your pet startup enter a foreign market?

“Of course!” you might say. After all, you’ve committed to your investors to scale and expand your business.

That’s completely fair. But did you notice that in all of the examples we talked about today, the startups established themselves in their home markets for years before going overseas?

For Rover, it was 7 years until they left the US and Canada. Tractive took 8 years before entering the US market. Lily’s Kitchen took 3 years to venture out of the UK.

Furthermore, most of these companies only expanded after achieving key funding milestones. This gave them the extra ammunition to conquer new territory.

All this to say don’t scale into foreign markets to the detriment of your business.

We’ve all seen startups that expand too fast and cannibalise their own growth (WeWork springs to mind).

If you have a solid team, excellent market research and a sustainable entry strategy, go for it. We believe in you!

However, if you’re still finding your feet in your company's home base, stay a while.

Build a solid foundation for your startup where you are. The world will wait.