Pet ownership has been a staple in many homes, across the Asia-Pacific region, for thousands of years. Since then, the number of pets and pet owners has steadily increased. However, the unprecedented boom in the Asian pet tech world shows the cultural shift from pet ownership to pet parenthood. With Asia being the third-largest market in the industry, pet tech entrepreneurs and investors have a unique opportunity to benefit from this fast-maturing sector.

The big picture

The Asia-Pacific pet care market is projected to reach $29 billion in value by the end of 2024, with an average predicted Compound Annual Growth Rate (CAGR) of 4% per year until 2029. This is due to a sharp rise in pet ownership and a higher GDP across the continent.

However, to understand the pet tech landscape in Asia, we need to look at how the pet industry at large is changing and where pet tech startups are prime candidates to meet the evolving needs of pet parents. Here’s what we discovered:

The millennial furbaby boom

One of the main drivers of the pet industry boom in Asia is a fundamental shift in cultural attitudes towards animals. Once the animal’s place in the home was for protection, service and occasionally companionship. Nowadays there’s a growing population of pet guardians who view their pets as family members, or even children.

I asked Rashi Narang, Founder & Creative Director at India-based pet store startup Heads Up For Tails, about the shifts she’s seen in the pet cultural landscape. She said, “I’ve been witnessing the transition from pet ownership to pet parenting over the past 17 years since we’ve been running Heads Up For Tails, and it’s been the most beautiful transition to witness. Pets are increasingly seen as family members, leading to a higher demand for premium and customized products. Consumers are looking for products that enhance the overall well-being of their pets, from food to grooming, toys and accessories.”

Many analysts equate the “furbaby” boom to the declining birth rate, urbanisation and smaller homes. Millennials simply aren’t having as many children compared with generations of old, to the great concern of local governments. For example, the Japanese government reported a 5.1% decline in the birth rate from 2022 to 2023.

It appears young people are pouring their parental instincts into their pets instead. In South Korea, e-commerce platform operator, Gmarket, confirmed that sales for pet strollers overtook baby strollers for the first time in late 2023.

It remains to be seen whether the parenting skepticism of the millennial generation will continue as Gen Z matures. However, initial surveys appear to be going that way. Goldman Sachs estimates that the pet population in China will almost double that of children by 2030 due to this seismic change in attitudes.

The wellness revolution

The shift towards pet humanisation has led to growth in the pet health sector too. Preventative health is of particular interest —especially post-COVID— with sales of pet dietary supplements projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% from 2022 to 2028 across the continent. South Korea-based pet food startup, Wooriwa, is seeing great success with treats focused on tackling specific ailments.

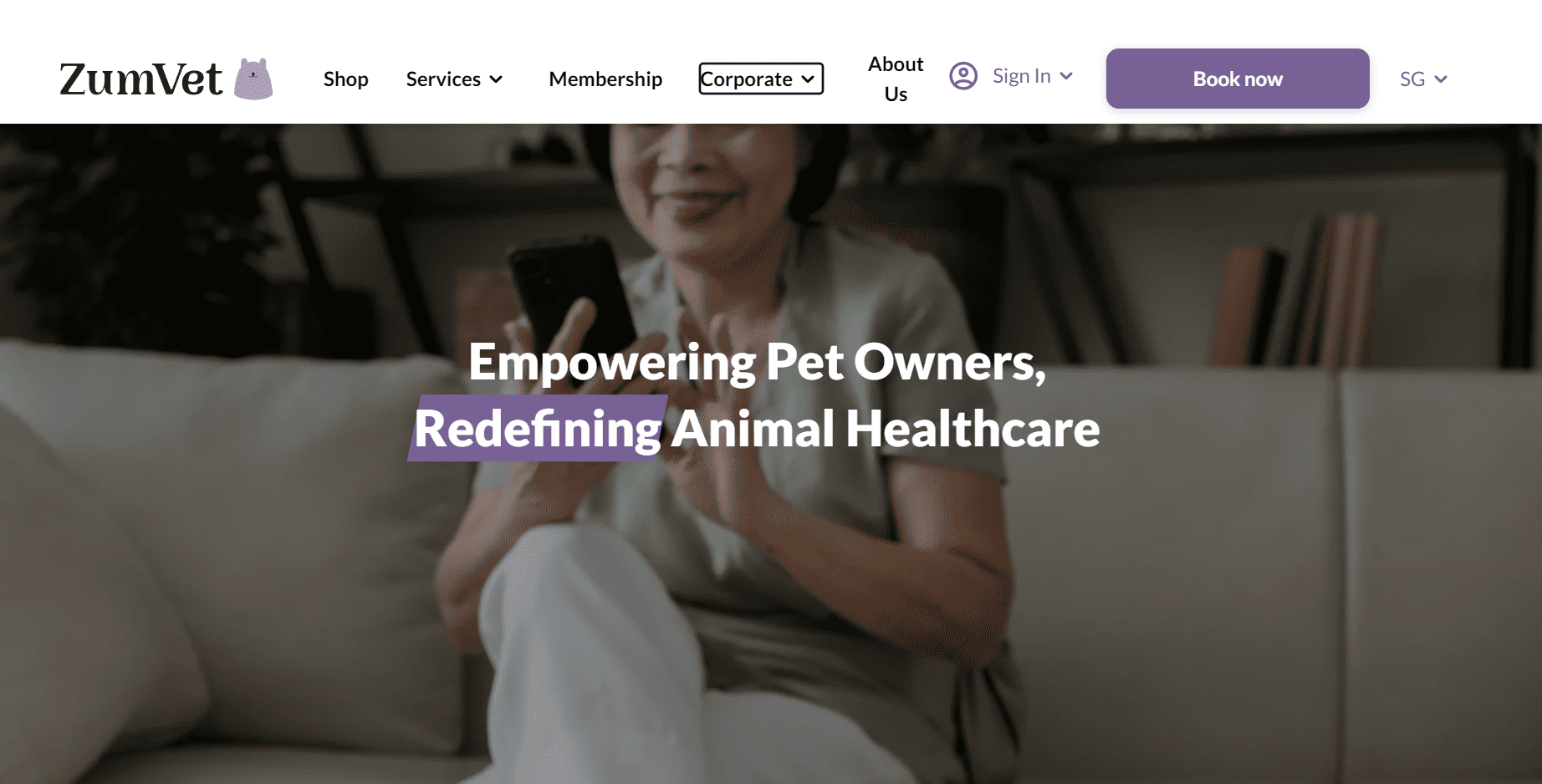

The fragmented veterinary services industry, across the continent, has also presented opportunities for pet tech startups to step in. Singapore’s ZumVet is disrupting the veterinary model by connecting concerned pet parents with licensed vets from the comfort of their homes. Athena Lee, CEO and Co-founder of ZumVet, said, “Televet services, like ours, are becoming increasingly popular in South East Asia. The surge in pet ownership has outpaced the development of veterinary infrastructure, so televet services provide a much-needed solution by offering pet owners the ability to consult veterinarians remotely.”

Likewise, investors such as multinational private equity firm, L Catterton, have sought opportunities in the pet health sub-sector. When reflecting on their experience of acquiring Japanese vet tech startup, Withmal, in 2023, Scott Chen, Managing Partner at L Catterton, said, “The vast majority of the nearly 13,000 pet clinics in Japan are small businesses, and many are owned by vets in their 50s or older with no succession plans. Joining Withmal is a potential solution as the group can continue running their practices after they retire. Withmal has grown over the years to become one of the largest veterinary service groups in the country.”

When pets become valued family members, their health and comfort are non-negotiable.

Elderly pet owners love pet tech

Though the furbaby trend gets the most press, it’s not just young people driving growth in the pet industry. Elderly pet owners in key markets, such as Japan, are leveraging pet service and technology solutions to better the lives of their pets.

For example, mobile grooming services allow elderly pet owners to maintain appointments from the comfort of their homes, avoiding the physical toll of taking their pets to the groomers.

Increased convenience causes a meaningful bump in sales. The pet service segment of the Asian pet market raked in an estimated $41.4 billion in 2020, which was predominantly led by mobile grooming services—that’s more revenue than pet food. Therefore, there’s an opportunity for pet startups to cater to an older demographic with more accessible technological solutions.

E-commerce is a huge driver of convenience and accessibility in the pet economy too. Chinese pet parents overwhelmingly shop online for all things pet-related. Studies show that 74.5% buy pet food, and 80.4% buy other pet supplies online. However, this is a growing trend across the region.

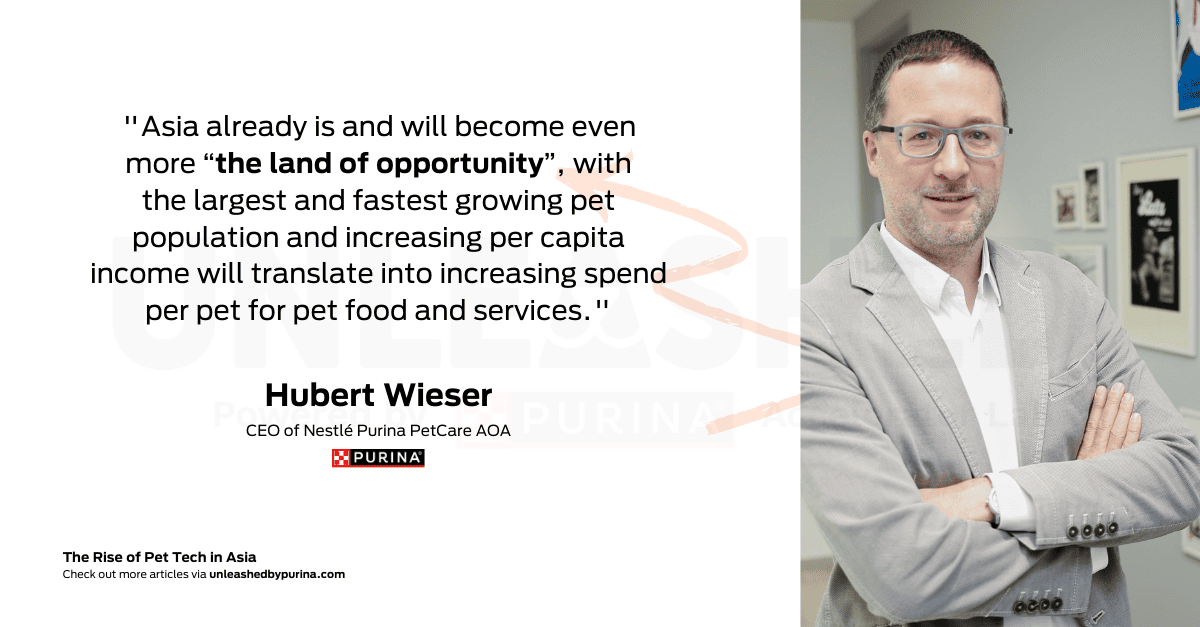

Hubert Wieser, CEO of Nestlé Purina PetCare AOA, said, “E-commerce continues to disrupt how pet parents shop and what they expect. Beyond e-commerce, the paths to pet parents are becoming more digitized, and pet parents expect relevant experiences and services that make their relationship with their pet as relaxed as possible—for life.”

The next phase in pet food

To keep pets happy and healthy, nutrition has been a major concern of the modern pet owner. This has led to an increase in premium spending in the pet food market.

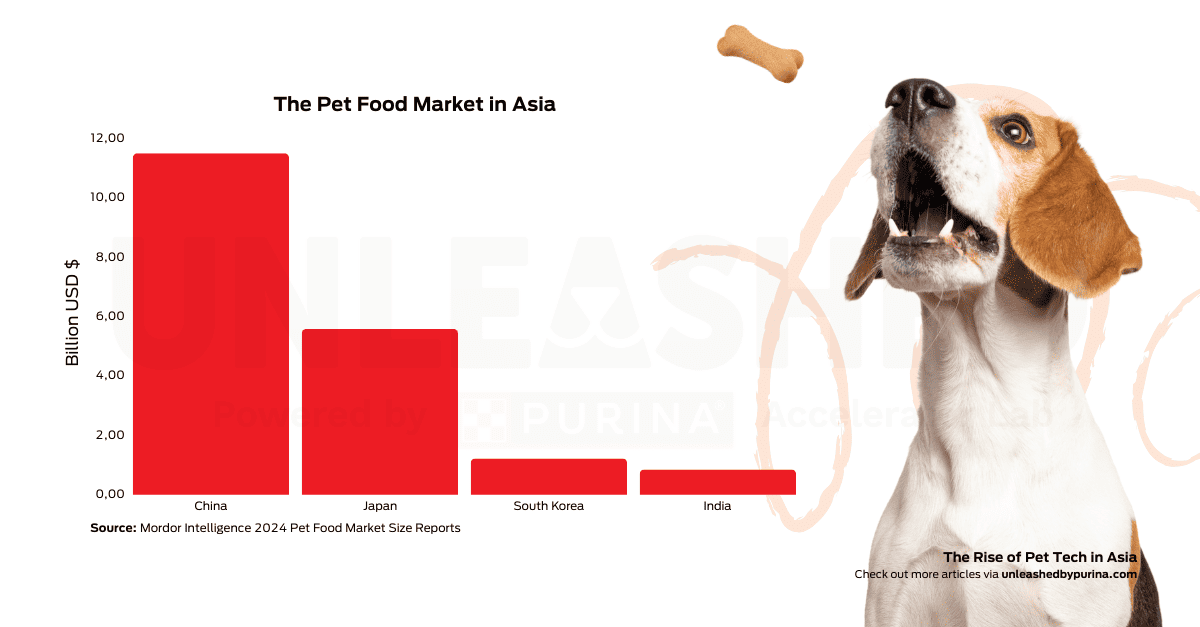

The largest player—China—shows rapid expansion in protein-rich, nutritious wet and dry food. South Korean pet parents are similarly investing in natural, premium food. The fastest growing vertical, in pet food in Japan, is veterinary food. While in India, the dry food market is dominant, and many Indian households still home-cook their pet’s meals.

Scott Chen, Managing Partner at L Catterton, comments on how infrastructural limitations could also be a factor in purchasing patterns across the region. “For instance, cold chain logistics are more developed in China than they are in India, such that fresh pet food offerings are more likely to gain traction in the former compared than the latter. Purchases of pet food are also mainly done online in China, whereas they are mainly done offline in India.”

Therefore, the prevalence of commercial protein-dense wet food diets in China, Japan and South Korea could be more of a technological shift than a cultural one. As the pet industry matures across the region, we’ll see how wet and natural food diets evolve in the public consciousness.

The AI takeover

The final key shift in pet startup culture is AI.

From pet identification (PetNow) to homecare apps (AI For Pet), the pet tech scene in Asia has embraced AI, and we are now seeing a great uptake in local markets.

Even non-AI-based startups are incorporating AI to get ahead of the curb. The aforementioned televet startup, ZumVet, is using their own proprietary AI system to support pet parents with preventative wellness tips.

For now, it’s primarily the health and wellness sector that are using AI. However, we’re certain to see AI used in increasingly creative ways to better the lives of pets.

Meet the main players

Given the diverse cultures, religious beliefs and attitudes towards pets across the continent, it’s challenging to summarize who those main players are in just one article. However, by looking at the macro trends in strategic locations, we can see where the opportunities may lie within the pet tech sector in Asia as a whole.

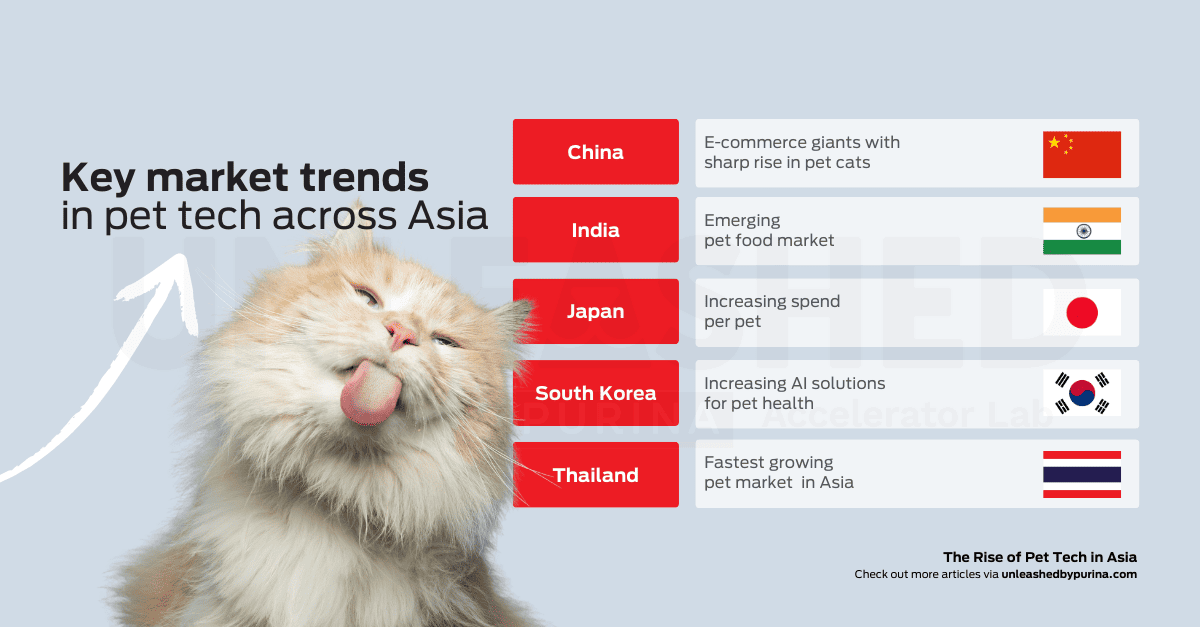

China

China is the biggest player in the Asian pet care market, purely because of its size. Though Gen Z and millennials are leading the boom in pet ownership across the country with 46.6% of pet owners born between 1990 and 1999.

Cats overtook dogs as the most popular pet, with over 69 million pet cats and only 51 million pet dogs—though dog owners spend a lot more than cat owners. And spend is the key word here. The pet craze has led to a huge boost in online retail and luxury spending on pets.

Sameer Mehta, Managing Director and Head of South East Asia at VC fund, DSGCP, said, “It is also worth noting that the inflection point for the pet market in China was when the GDP, per capita, reached US$7,000 in 2013. The pet care market grew from US$3 billion in 2013 to 51 billion in 2021. In the same period, the number of pets (dogs and cats) grew from 40 million to 110 million.”

The giants in Chinese pet tech are focused on bringing greater convenience and insights for pet owners. PetKit provides a wide array of pet food feeders, self-cleaning litter boxes and water dispensers. The company ships internationally and secured $20 million in funding in their Series C round. Online retailers, like Boqii and EPet, are also riding the e-commerce train. Even larger companies, like Xiaomi, have hopped on the pet bandwagon, seeking a slice of the $83 billion pie.

India

Another giant in the pet space is India. Out of all Asian countries, India has the second fastest growing market in the pet food industry—behind the Philippines—which is driven by more millennials adopting pets and primarily feeding them commercial pet foods, as opposed to providing their pets with a home-cooked meal.

Indian households show a greater diversity of pets, too. Though dogs reign supreme, the pet rabbit population is projected to increase by 26% by 2032.

In the pet tech space, promising startups, like e-commerce platforms Supertails and Heads Up For Tails, secured $15 million and $37 million respectively in their latest funding rounds.

Though it’s important to note that India has some way to go when it comes to widespread attitudes towards pets. So far, the “pet as family” ideal is predominantly concentrated in major cities. The infrastructure and spend per pet trails behind China and Japan for now, but India has possibly the best growth potential in the field currently.

Japan

Contrary to the trend across the region, the dog population in Japan declined overall between 2018 and 2024. Rising pet food prices are pegged as one of the reasons behind the decline. Furthermore, dogs are the most popular pet in Japan but smaller homes and limited outdoor space has led to fewer people adopting canines.

Despite the decline in pet dogs, the combined number of companion cats and dogs in the country has surpassed the number of children under 14 years old. So the furbaby boom appears to ring true here.

Those who can comfortably afford to have pets are spending more than ever on health and wellness. Premium and organic nutrition is on the rise as well as pet health and wellness centers.

In the pet tech realm, AI and wearables are helping Japanese consumers gain further insights into their pet’s health. Homegrown cat-tech startup, Rabo, found success with their health-monitoring smart collar and litter box. The company secured over $10 million in Series B funding in 2022. AI-powered cat health app, CatsMe! is also gaining traction attracting over 230,000 users across 50 countries.

South Korea

Though South Korea has one of the smaller markets in the pet industry within Asia, it’s also one of the most dynamic and promising.

The number of registered dogs and cats increased by 7.6% in 2023 and has shown steady year-on-year growth.

The leading startups in the pet tech realm, like PetNow, AI For Pet and PetPuls, are also embracing AI to provide pet identification, homecare and emotional detection respectively.

“Pet humanization is the biggest shift I’ve seen in Korea. As the birth rates are plummeting, people are taking care of their pets like babies. So they are more likely to invest in premium stuff, like premium food, healthcare, etc. Koreans are definitely willing to spend more than ever before on their pets.” Johnny Jaewon Shin, Business Development Manager, PetNow.

The up-and-comers

The bigger markets can overtake the shine of smaller countries, but pet innovation is happening in all corners of Asia.

Second to India, Thailand is pegged as the fastest growing pet care market with a CAGR of 8.7%.

South East Asia is home to some of the hottest names in Asian pet tech. For example Petotum, the first aggregated pet care services app in Malaysia, and Singapore-based pet retailer, Perromart.

So, although China and Japan’s pet markets are the most developed at the moment, there are opportunities across East and South East Asia.

The land of opportunity?

Hubert Wieser, CEO of Nestlé Purina PetCare AOA, said, “Asia already is and will become even more “the land of opportunity”, with the largest and fastest growing pet population and increasing per capita income will translate into increasing spend per pet for pet food and services.”

Despite Asia being the land of opportunity in many ways, it’s not without its challenges. The startup founders I spoke to cited fragmented markets as a common hurdle when trying to scale.

ZumVet CEO and co/founder Athena Lee said, “It was a challenge having to adapt to each country's distinct languages, cultures and consumer behaviours, requiring localized strategies. One example was when we were preparing for our launch in Indonesia; we had to overhaul our customer support channels to adapt to local preferences.”

Lower spend per capita also means slower growth for pet tech in India and South East Asia. Sameer Mehta, Managing Director and Head of South East Asia at VC fund, DSGCP, told me, “While there is a significant runway for growth, and investors are starting to realize the untapped potential here, spending per pet is still relatively low compared to Western markets. In our view, while the pet tech space is still untapped and offers significant opportunities, the GDP per capita of SEA and India will need to increase significantly for more mainstream adoption of pet tech products, which is what we have seen in more developed Asian markets such as China, Korea and Japan.”

Furthermore, while investors are starting to take note, there are far fewer opportunities for investment and nurturing of pet startups. The lack of support for pet startups in Asia was one of the motivations behind expanding Unleashed by Purina, Nestlé Purina’s startup accelerator, to include startups based in AOA.

With all this in mind, it makes sense that homegrown pet startups still have ambitions of conquering that all-important US market, particularly in the tech realm where new innovations can easily translate to foreign markets.

The US market is still the mecca for the maturity and growth potential of pet businesses today. To truly become a unicorn in the pet space, which is the ambition of many founders, the US market cannot be ignored. But unless homegrown startups are given more funding opportunities and support, it may take a long time to see that dream come true.

A wag-worthy future?

Johnny Jaewon Shin, Business Development Manager of PetNow, said it best when he told me, “The pet industry in Asia is booming. Booming means it's getting bigger, but it hasn’t reached its full potential yet.”

And the growth potential is astronomical. Graphical Research estimates the Asia-Pacific pet care market will reach a value of $132 billion by 2027.

For aspiring local entrepreneurs and international investors, riding Asia’s growth spurt in the pet tech space could yield unparalleled returns. Even though, like with any emergent market, growing pains are par for the course.

It comes down to this; as the GDP rises across the region and pet parenthood cements itself in the culture, the Asian pet tech market could rival that of Europe in terms of growth opportunity by 2027. It’s time for the industry at large to perk up its ears.

Written by Olivia De Santos, Pet Tech Writer @ Unleashed by Purina.